Binary Option and Forex Trading Strategies Using Candlestick Hammer

After previously we discussed some strategies using candlesticks or indicators, this time I will discuss "Binary Option And Forex Trading Strategies Using Candlestick Hammer".

What is the Hammer Pattern?

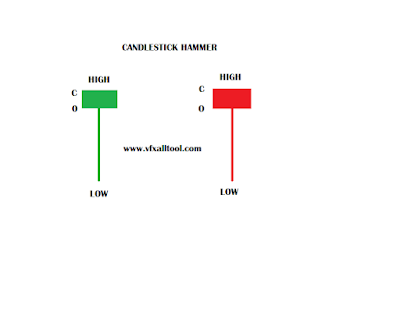

Hammer patterns are the most common candlesticks and are very easy to analyze in the technical market including forex trading, binary options, and crypto. Hammer candlestick patterns will generally appear at the end of the price trend, which has a small body shape and a long axis. of the size of the body. Hammer candlestick patterns include reversal patterns that often appear at the end of a downtrend or uptrend.

|

| Candlestick Hammer |

Here is an example of a hammer candlestick on the market.

|

| Candlestick Hammer |

Like the picture we saw above, candlestick hammers have very small bodies and have long axes. It shows Bearish conditions can push the price down.

Once you know the hammer candlestick, the next step is how to use the candlestick hammer.

For example, the price movement chart of an asset that you see below agrees on the price followed by the hammer candlestick pattern. This pattern has a tail that is more than twice as long as its body. This indicates that there will most likely be a price reversal from below up.

Confirmation, in this case, will be very good if used, actually, this confirmation comes on the next candlestick pattern. We'd better confirm First so that we are confident in buying the price. For binary options trading, we can make a purchase with an ideal period of 1-3 minutes. while for forex trading, we can place a stop loss starting below the lowest hammer price.

Post a Comment for "Binary Option and Forex Trading Strategies Using Candlestick Hammer"