5 Minute Trading Strategy For Deriv Platform - DYNAMIC STRATEGY

Hello traders! Will not get bored We here continue to provide information about trading strategies. There are several trading strategies that we have shared for Forex platforms, crypto, as well as binary options. But in this article, We will share a very dynamic trading method for binary options platforms. That is, the Deriv/binary.com platform, with a trading duration of 5 minutes.

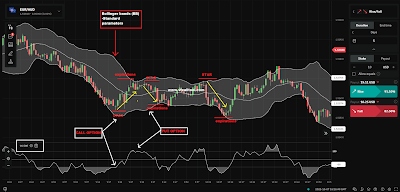

The standard technical analysis tools available on all trading platforms are the most reliable and simple way for Us to make money trading binary options (DERIV). The "DYNAMIC" strategy proves it by using trend indicators and an assessment of the dynamics of price movements. The following are the characteristics of the strategy that We will share:

- Type: Inclination.

- Timeframe: M1-M5

- Trading assets: Any currency pair. The main requirement is a fixed spread (2-3 points) and no hidden fees.

- Trading time: All Forex trading sessions.

Indicators

Bollinger Bands (BB) indicator.

Commodity Channel Index (CCI) indicator.

|

| Deriv platform |

Trading Signals To Make RISE/FALL Buys:

Fall. To make a purchase down or "FALL", the condition is actually the opposite. The price has not crossed the upper limit of the Bollinger or the price breaks the middle from top to bottom. The CCI indicator is below zero. To understand it see the image above the section "PUT OPTION".

- The longer the sideways movement of the Bollinger Bands continues, the higher the likelihood of a strong trend after its completion. In such cases, you can open a trade at the first sign of a CCI reversal.

- During the publication of important fundamental news and statistics, not open options 30 minutes before the news and 30 minutes after publication, We can close the current transaction.

- If there is a good and possible trend, you can open several options with different expiry dates to take maximum movement with minimal risk.

Post a Comment for "5 Minute Trading Strategy For Deriv Platform - DYNAMIC STRATEGY"