The 5 Most Accurate Chandlestick Patterns - For Trading

Of the various types of candlestick patterns, some are the most accurate, and you must know. But before continuing with this discussion, even though you understand this first "Basic Candlestick Shapes & Candlestick Patterns "

Here are 5 of the most accurate candlestick patterns for trading that you should know and understand:

- Bullish engulfing

- Piercing line

- Morning star/Morning (Doji) star

- three blue solder

- Rising three method

You need to know that each candlestick pattern shows the opposite direction. For example, we take the bullish engulfing candlestick pattern, this bullish engulfing candlestick informs the direction of price movement will go up, then bearish engulfing, bearish engulfing which informs the direction of price movement will go down.

However, the candlestick pattern that we will discuss is a candlestick pattern with a very ideal pattern and the best of various other types of patterns. But there is little tolerance in its use that any candlestick pattern or strategy does not have to be 100% the same in the conditions of this article, at least they are similar.

The following is an explanation of the most accurate and profitable candlestick patterns:

1. Bullish Engulfing

|

| candlestick bullish engulfing |

In this form of candlestick pattern, engulfing means the newest candlestick and embraces the previous candlestick. In this candlestick pattern, as we can see, candlestick 1 is between the body of candlestick 2 (the shadow that appears on candlestick 1 we don't need to see). That's why the term "hug" appears.

The following are the requirements for an ideal bullish engulfing candlestick pattern:

- This pattern should occur at the bottom of the downward price movement

- The second candlestick body must cover the 1 candlestick body

- the opening or closing of the 1st candlestick must be below the opening or closing of the second candlestick

- opening or closing (one) of the 1st candlestick may also be the same as opening or closing (one) of the second candlestick

- Candlestick 2 it would be nice to be a long body candlestick

- Candlesticks 1 and 2 must be different colors

- Candlestick 1 must be red to indicate the direction of the price going down

- Candlestick 2 must be green to indicate the direction of the rising price

- The confirmation line is the price of the opening or closing of the candlestick before the candlestick 1

- The volume of the 2nd candlestick must be greater than the 1st candlestick

|

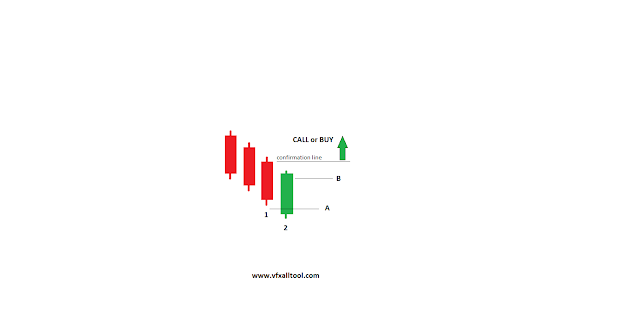

| piercing line |

The newest candlestick piercing line "pierces" the previous candlestick. We need to know that in this pattern, it's as if the pattern of candlestick 2 "pierces" candlestick 1.

The following are the requirements for the piercing line pattern:

- Must occur at the bottom of the trend of the price going down

- Candlesticks 1 and 2 must belong body candlesticks

- Candlestick 1 must be red

- Candlestick 1 must be blue

- Open candlestick 2 must be at the bottom of the lowest candlestick 1 (below line A)

- Closure of candlestick 2 must pass at least half of the body of candlestick 1 (above line B)

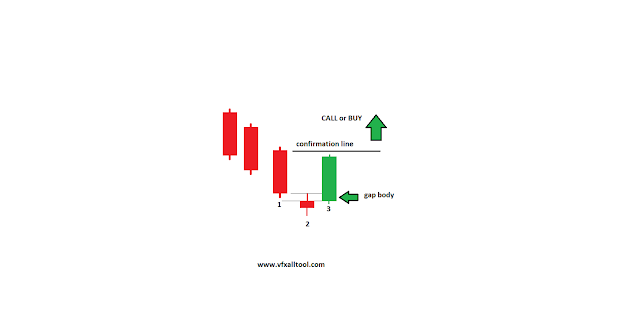

3. Morning (DOJI) star

|

| morning (Doji) star |

This morning Doji star forms a small "star" which appears on a dark night (red bearish candlestick) and then appears the "little star" which will make the atmosphere bright (blue bullish candlestick).

The following are the conditions for an ideal morning (Doji) star:

- Must occur at the bottom of the trend of the price going down

- Candlestick 1 must be red

- Candlestick 2 must be red

- Candlestick 3 must be blue

- Candlesticks 1 and 3 must belong body candlesticks

- Chandlesti 2 must be a small body

- Candlestick 2 must have a body gap with Candlestick 1

- The opening of the candlestick 3 must close either below or above with the closing of the candlestick 1

- Chandlestik volume 3 must be bigger

That is the condition for the morning (Doji) star that you must know, for confirmation it is not really needed but it would be better to wait for price movements to cross the confirmation line. Especially for the morning (Doji) satr, the second candlestick must be in the form of any doji.

4. Three Blue Soldier

|

| three blue soldier |

These three blue soldiers, which means three blue candlesticks appear. This pattern shows a very strong bullish trend.

The following is the three blue soldier candlestick pattern wings:

- Must occur at the bottom of the trend of the price going down

- Candlesticks 1, 2, and 3 must belong body candles

- Candlestick sizes 1, 2, and 3 should not be much different

- The opening of Chandlestik 2 must be below the closing of Chandlestik 1, while the closing of Chandlestik 2 must be above the Closing of Chandlestik 1

- The opening of the candlestick 3 must be below the closing of the candlestick 2 and the closing of the candlestick 3 is above the closing of the candlestick 2

Confirmation is not needed, but it would be nice to wait for the price movement to cross the confirmation line. The confirmation line is the third closing of the candlestick, the higher the candlestick volume the better, and will be accurate of course.

5. Rising Three Method

| |

| Rushing three methods |

The following are the conditions for the most ideal Rising three method :

- Must occur when trending up (required)

- Chandlestik color 1 must be blue

- Chandlestik color 2 is free, it would be nice to have blue

- Candlesticks 1 and 3 must belong to ODI candles

- Candlestick 2 must have a small body

- Candlestick 2 sabiknya must be a collection or group consisting of 3 small body chandel

- The set of candlesticks 2 must be between (below) the highest and (above) the lowest candlesticks 1

- The closing of the third candlestick must be above the 1st candlestick

That is the most ideal and accurate candlestick pattern, which we can use and take advantage of in trading. This candlestick will be more ideal if it is combined with a signal that has been tested and pro, to get a pro signal you can click HERE.

You need to know that in using candlestick analysis, the most important thing is, the position of the candlestick pattern. Position means where the candlestick pattern appears.

Post a Comment for "The 5 Most Accurate Chandlestick Patterns - For Trading"