Candlestick Hammer - What Does a Hammer Mean in a Candlestick?

What Does a Hammer Mean in a Candlestick?

Candlestick Hammer is a very powerful indicator tool or candlestick form in the trading strategy. This candle indicates a reversal in an up or downtrend but is most effective when it forms at the bottom of a downtrend.

This pattern is formed when the price initially starts in an uptrend, however, the momentum is slowly decreasing towards the center of the chart. Then, it moves downwards in a corrective phase. Beginners often make the mistake of ignoring the candlestick hammer.

The hammer is not a reliable technical indicator or candle on its own but rather a combination of other indicators is preferable. The closing price is related to the opening price. Usually, a closing price that is above the opening value of a period means the price will rise to a higher high.

It should be noted that if you use this strategy, you must place your stop loss under the shadow of the hammer. Despite its drawbacks, the HAMER candlestick pattern is a good contrarian trading setup and can give traders a clear edge.

This hammer pattern is most useful when the trend is starting to change. The hammer will be a strong contrarian trade setup if the market is trending downwards. However, this hammer is not recommended for trading against the trend.

The hammer candlestick is an important indicator of a downtrend. The hammer's lower wick indicates that the price is testing support. If you are a newcomer to candlestick trading, HAMMER is the best way to start your trading.

Apart from that, the candlestick hammer is the best tool for learning the ins and outs of candlestick patterns. It signals buying and selling pressure, and not an immediate trading signal. But it does produce a sign that the trend is about to reverse. In other words, the hammer is a directional indicator that signals a shift in balance.

The hammer candlestick is a bullish reversal candlestick formation. It occurs when the price decreases and sellers enter the market. The hammer candlestick has a short body and a long upper shadow. If the top and bottom are the same, then HAMMER is a bullish candlestick. This formation can be used as a warning sign in a trading strategy.

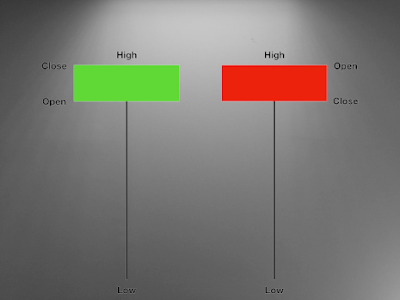

When a hammer candlestick forms at the top of the chart, it is a bullish pattern. The body of the candlestick is different from the one below. When the body of the candlestick is red, it indicates that the selling pressure is very strong, vice versa.

Post a Comment for "Candlestick Hammer - What Does a Hammer Mean in a Candlestick?"