Best Pocket Option Strategy Using a Combination of Indicators

In this article I will again share the best pocket option trading strategy, this strategy uses a combination of indicator options. In using this strategy we need 5 indicators to apply so that using this method the results will be more effective. 5 indicators may seem like a lot, but the main thing is that the results are accurate.

First, we need to set up the indicators accurately and for each one, it is important to find the right entry point. So, let's get started on how this indicator works which we are going to discuss. You must have a pocket option account first to test this strategy.

Here is the strategy:

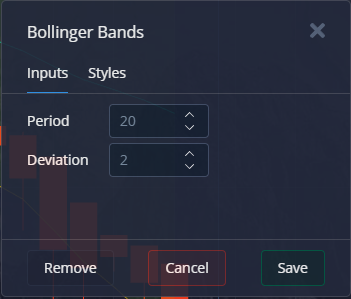

Use a candle (Heikin Ashi) with a duration of one minute like the picture you see above. This method does not work on regular candles and only works on Heiken Ashi candles. The first indicator we have to apply is the Bollinger Bands indicator and the period uses 20 and two. You can adjust the color according to your convenience when trading.

Choose the Bollinger Bands indicator again, but with a different period of 20 and three. During this period the puncture is calculated for activity higher currency pairs.

Next, apply the stochastic oscillator indicator, this indicator is the main signal in this method. For the period is 7,3, and 3 (SMA).

The next indicator is the CCI indicator, which uses period 22 because the activity of this indicator is relatively less sensitive. The last indicator that you should apply is the ADX indicator, use periods one and five. This indicator also gives strong signals in this method. If the five indicators have been successfully installed, please select the currency we want to trade. Minimum currency pair recommendation 80% profit.

The thing you should know is that in using this method firstly that the moment does not appear so often, so we must patiently wait for the right moment to use this method. Because there are many indicators in using this method, so each indicator requires good observations before entering a trade.

Post a Comment for "Best Pocket Option Strategy Using a Combination of Indicators"