How To Read And Understand The Bullish Doji Star Candlestick In Forex & Binary Options Trading

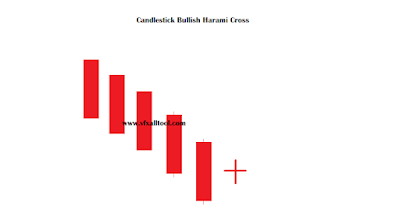

Previously, we have discussed and shared trading strategies using Bullish Harami Cross candlestick pattern analysis which has a high level of accuracy medium. In this article, we will share a forex or binary options trading strategy using the Bullish Doji Star candlestick pattern.

The Bullish Doji Star candlestick has medium accuracy, but you don't need to hesitate and worry about using this candlestick pattern, because Here I will tell you how to read and understand the Bullish Doji Star Candlestick pattern in Forex and Binary Options trading.

The Bullish Doji Star candlestick pattern usually tells you that a Bearish market trend or price has ended and a Bullish trend is starting. This is a point to start buying shares on the trade. However, as we said above, the candlestick pattern Bullish Doji Star has a medium accuracy and is not too high.

We need to wait for confirmation before we do purchase. So that you better understand the Bullish Doji Star Candlestick pattern, let's look at the image below:

|

| Bullish Doji Star Candlestick |

You can see in the picture above, that the Bullish Doji Star Candlestick pattern is formed by one Doji candlestick which has an up and down tail. the same length. The Doji candlestick forms a cross and is located below the previously formed red candlestick. The Doji candlestick tells us that previously, the Bearish candlestick was still dominant.

Then, the Bullish candlestick can build a strong defense so that the Bearish candlestick can't push forward any further. Bullish had pushed the Bearish candlestick back, although, in the end, the two prices were back at the starting point of the price battle, and nothing can dominate the price battle. This means that in this case, the Bullish and Bearish candlesticks are really equally strong.

If we look up here, we can't predict prices in the next market. But you need to note that the Doji candlestick is formed after long bearish candlestick domination. This means that the candlestick tells us that the strength of the Bearish candlestick is starting to weaken and the strength of the Bullish candlestick is getting stronger.

If we look up here, we can already predict that the Bearish candlestick will continue to weaken and the Bullish candlestick will continue to strengthen. This means that the Bullish candlestick will dominate the price of a market in the future. However, there is still an element of uncertainty at this point. Why is it still uncertain? Because the opposite could happen, even Bearish candlesticks can continue to dominate the price again.

Therefore, as I said before that confirmation is very important before making a purchase. Confirmation that the Bullish candlestick has actually overcome the strength of the Bearish candlestick. To understand the confirmation, you can see the picture below this:

|

| Bullish Doji Star Confirmation |

Post a Comment for "How To Read And Understand The Bullish Doji Star Candlestick In Forex & Binary Options Trading"